Recent attacks by Houthi rebels in the Red Sea have forced ships to detour around the Cape of Good Hope, preventing ships from passing the Suez Canal, extending voyages from Asia to Europe by approximately 14 days or more.

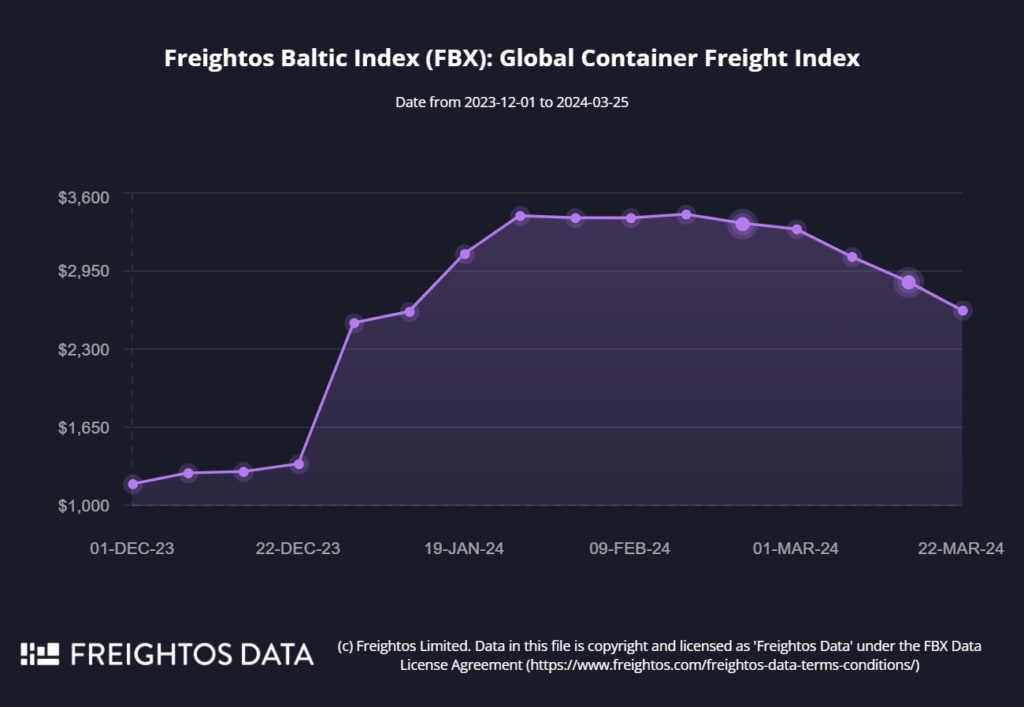

These attacks have decreased global shipping capacity and significantly raised shipping costs. The altered route around Africa is currently taking up approximately 16% of global shipping capacity. The impact extends beyond the directly affected region, causing a decline in global trade flows and an increase in shipping prices worldwide. Since the beginning of the attacks in December 2023, global freight rates have more than doubled, slowly showing a slight decrease again (see image 1). Even though attacks are local, actively affecting trade between Asia and Europe, the Global Container Freight Index suggests that local issues have significant ripple effects on the global economy. As geopolitical tensions continue to rise, such disruptions may become more frequent. However, as shipping companies adjust their operations in response, they may mitigate the impact of future shocks by operating with greater slack.

Another problem that arises from the detours via the Cape of Good Hope is the lapse of updated shipping schedules. Therefore, freight forwarders who utilize technologies such as CargoWise One to allow their customers to track the whereabouts of their cargo automatically, might misinform their clients, as most carriers are still displaying Suez shipping times. This significantly increases freight forwarders’ need for manual schedule checks and direct customer communication, therefore decreasing operational efficiency and business margins.

Furthermore, the delays in ship arrivals are disrupting both port operations and hinterland transport, causing logistical challenges and inefficiencies in cargo handling. This punctuality issue is impacting the timely movement of goods, further impacting supply chains.

Last but not least, due to the increased distance between Asia and Europe, CO2 emissions are also increasing by at least 31 – 66%, as this is the additional distance, depending on the ports of origin and destination. Additionally, vessel may increase their speed to make up for the extended shipping times and simultaneously further increasing emission intensity. Lastly, in order to compensate for the reduced capacity, between Asia and Europe, smaller and therefore less fuel-efficient vessels are currently deployed.

Image 1: Global Container Freight Index (Freightos Baltic Index FBX) from December 2023 until March 2024 (Source: Freightos)

Sources: Freightos, CEPR, Sea-Intelligence, fr-8 experts