“Shortage of empty containers, oligopolies, and a volatile market environment”

This is the headline of an article recently published by ÖVZ (Austrian Newspaper for Transport and Logistics) summing up a discussion round with Austrian industry leaders and experts, including fr-8 CEO Alexander Freil.

Challenges and opportunities facing maritime logistics and port hinterland transport were brought to light. Against the backdrop of the global Covid pandemic and current geopolitical tensions, especially in the Red Sea, the resilience and adaptability of supply chains have once again come under scrutiny. Let’s delve into the key takeaways from this dialogue:

- Shortage of Empty Containers: There’s a significant shortage of empty container due to reduced import volumes, leading to increased flexibility demands in hinterland terminals. This also leads to additional costs for empty container procurement for shippers, as they are likely only partially chargable to customers.

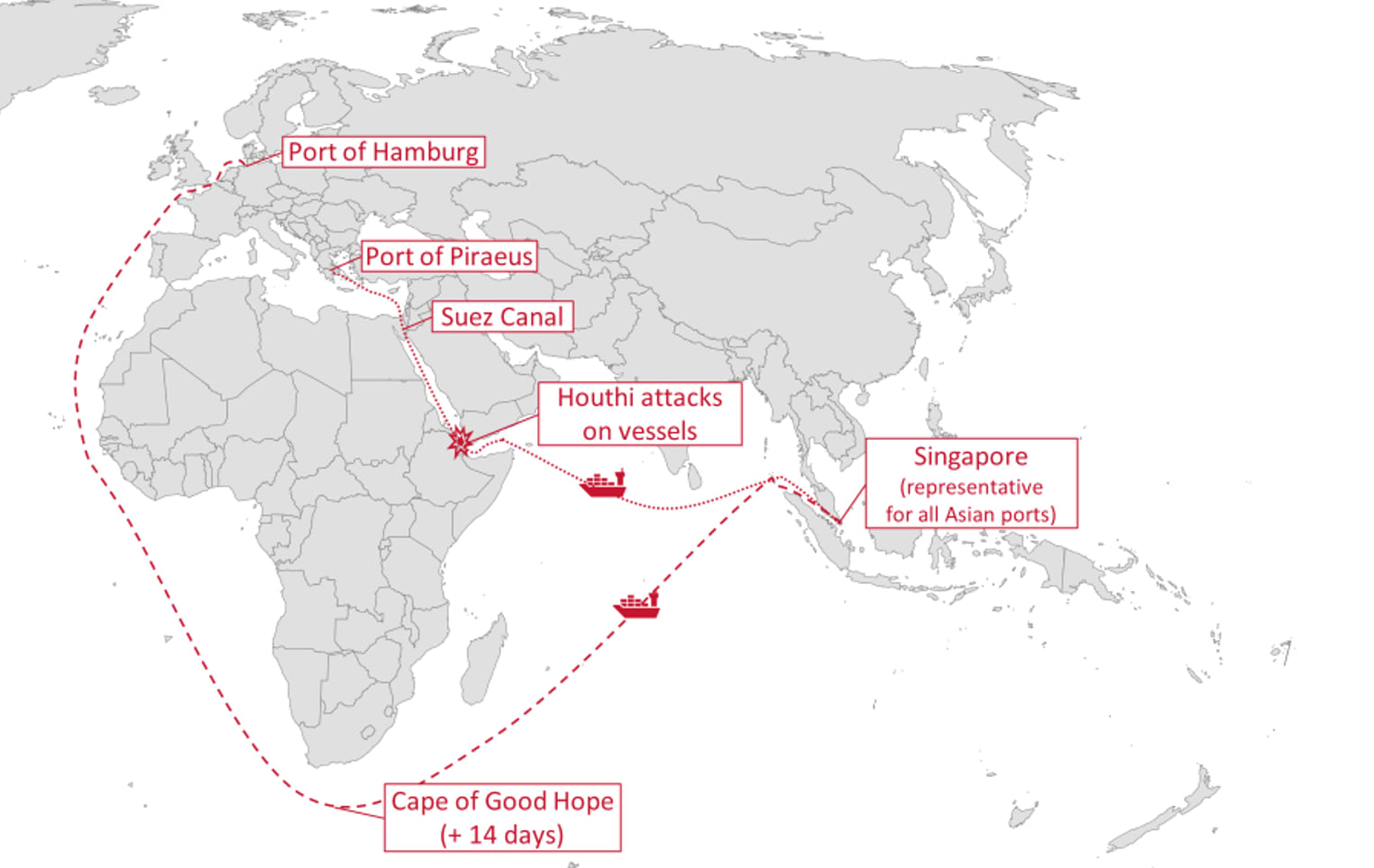

- Impact of Geopolitical Events: Houthi attacks in the Red Sea have disrupted liner services, affecting ports differently across regions, with Hamburg and northwest continent ports benefitting from altered routes. Due to the necessary detours around the Cape of Good Hope to avoid the Suez Canal, punctuality of ships is at a low point with delays of up to three days.

- Oligopoly Formation Among Shipping Companies: Concerns arise over the power of shipping companies, making it harder for smaller players to assert their rights in case of a legal dispute.

- Infrastructure Challenges: Development of larger ships poses challenges for port infrastructure and hinterland processes, requiring ongoing expansion and automation efforts.

- Talent Retention Challenges: The logistics industry struggles to attract and retain young professionals amidst volatile market conditions and stressors, sea freight professionals are especially rare.

- Rail Infrastructure Modernization: There’s consensus on the urgent need for rail infrastructure modernization, but short-term decision-making by governments complicates long-term contracts and planning.

- Trends in Integrated Logistics: Some shipping companies are moving towards integrated logistics services, aiming to make traditional freight forwarding obsolete, therefore impacting freight forwarders’ competitiveness.

- New wind in green logistics: Efforts to make logistics more sustainable slowed down amidst Europe’s weak economic activity, but future ESG reporting requirements and the EU taxonomy regulation are expected to drive new momentum, especially in rail logistics in Europe.